Take a trip with me back in time.... It was a year ago from today. I'm a nurse and my wife is a teacher. We made good money and were expecting our first baby (it's a girl by the way and she is perfect but more on her later).We both drove brand new cars, loved going on vacations, and didn't really think twice about budgeting since our monthly income was comfortable. We had money in the bank and always payed our bills on time. If we wanted a new fridge, we got it. Why not throw in a washer and dryer as well? With the small monthly payments and zero interest financing, we couldn't afford NOT to get them! I mean come on, the monthly payments were only $100. That's nothing!

The problem is, those nothings started adding up quickly. My wife, Tomi, and I sincerely thought we were doing well financially.We were basically normal. Neither of us had spending problems, gambling addictions, or stock piles of debt hidden away (key word: hidden). What we did have were student loans, car loans, interest free financing, and minimal credit card debt. But, hey, who doesn't in today's society? Those things are just a normal part of life in modern day America.

Remember that perfect baby girl I was telling you about? Well, on February 2nd, 2017, our daughter Poppy Leigh Colburn entered the world. All of the sudden, the term "financial future" had a name, chubby cheeks, and a beautiful little baby face. Our goal from the beginning was for Tomi to be a Stay at Home Mom (SAHM).

SIDE NOTE: I am so grateful for my Wife. Tomi, if you are reading this, know that I truly appreciate the fact that you want to be home with our sweet Pop-tart. You are making a difference in her world and mine! You are over worked and under paid. There is no amount of money that could replace what you do. You are the unsung hero of our household. I love you!

I had recently started a new job with a nice income and felt confident that everything would sort itself out. Since we knew Tomi wasn't going back to work, we started taking a deeper look into our financial fitness. On the surface nothing looked too alarming. We had about $9,000 in financing and credit card debt (all interest free), student loans, and two car payments. Sounds normal right?

Well, It turns out that NORMAL IS BROKE!

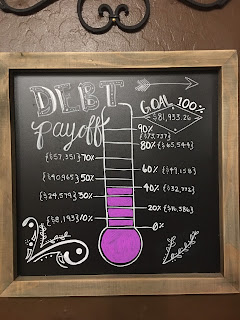

The sum of everything we owed was over $81,000.

EIGHTY ONE THOUSAND DOLLARS!!!

I couldn't breathe. I remember staring at the computer screen in disbelief. Clearly, that was incorrect. My fingers moved to ease my fears and prove that this was some kind of user error. I probably added an extra zero in somewhere. Oops! To my chagrin, the calculator stubbornly refused to change its tune. The reality of the situation finally began to sink in. How had I let this happen? And more importantly, how had the fact that we were completely drowning in debt escaped our attention?

We weren't irresponsible. We monitored our bank accounts and payed our bills on time. We only bought things we could afford. We thought we were living within our means. Sure, we took out loans for college but that was an investment in our future. And yeah, we borrowed money to buy our cars but that's what everyone does. How else are you supposed to afford a twenty-six thousand dollar vehicle???

SIDE NOTE: That's actually a trick question. It turns out that if you don't have the money to buy something, then by definition, you can't afford it. I'll save the rant on car payments for another day.

You see, Tomi and I were only paying attention to what our monthly payments were. We didn't consider things like zero percent interest financing, student loans, or car payments as "debt." I guess we just saw them as necessary tools- used to get ahead in life. Buy something now and let "future" Drew and Tomi pay for it later.

But what happens, when the future finally arrives? What happens when you desperately want your wife to be able to stay at home and take care of your daughter? All of the sudden, you start to view things with a different perspective. All of the sudden, the kind of car you drive doesn't matter; having a fridge with a built in ice maker and water filtration system seems trivial. Planning a cruise to the Bahamas doesn't feel like a wise decision.

People that are eighty one thousand dollars in debt don't drive fancy cars, go on expensive vacations, and fret over getting a new kitchen table. That would be STUPID!

Hello, my name is Stupid. Nice to meet you.

The number crunching continued. We figured out that every month, we sent out an average of $1,519 in minimum payments to our creditors. At the time, we could easily afford it. Faced with the loss of an income, those numbers got a whole lot scarier.

Thank God for Dave Ramsey! My brother told me about his "baby steps" and a friend from work gave me a copy of his book, "The Total Money Make Over.". I shared them with my wife and we both jumped in full force. We have been living on a beans and rice budget ever since. In four months we have paid off thirty one thousand dollars. It's required a LOT of sacrifice, hard work, contentment, and understanding from our friends and family. It's my hope that this blog will encourage others in a similar situation to take control of their financial future.

Comments

Post a Comment